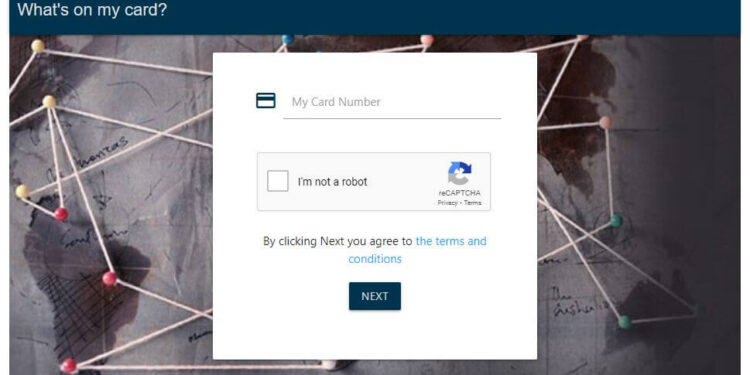

What’s On My Card?

If you’ve ever looked at your credit or debit card statement and wondered, “What’s on my card?”, you’re not alone. With the rise in digital transactions and contactless payments, it’s easy to lose track of what you’re spending, who charged you, and why. In this blog, we’ll help you break it all down — from